how to pay taxes instacart

Gig workers must pay federal income taxes and a 153 self-employment tax on earnings above 400. When youre using the Instacart app youll be charged an estimate of the amount of taxes and fees youll be charged.

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

If you do Instacart for extra cash and have a W-2 job.

. Instacart and Amazon flex adventures. To add a payment on the Instacart website At the top left click the 3 horizontal lines. For one thing your tax situation will actually vary depending on whether youre an in-store.

45000 x 153 6885. Instacart taxes are much easier than dealing with crazy Instacart customers but you have to go step-by-step. This can sometimes be more or less than the total you.

Tax tips for Instacart Shoppers. This includes driving for Uber or Lyft delivering food or groceries or. If you made 45000 youll pay.

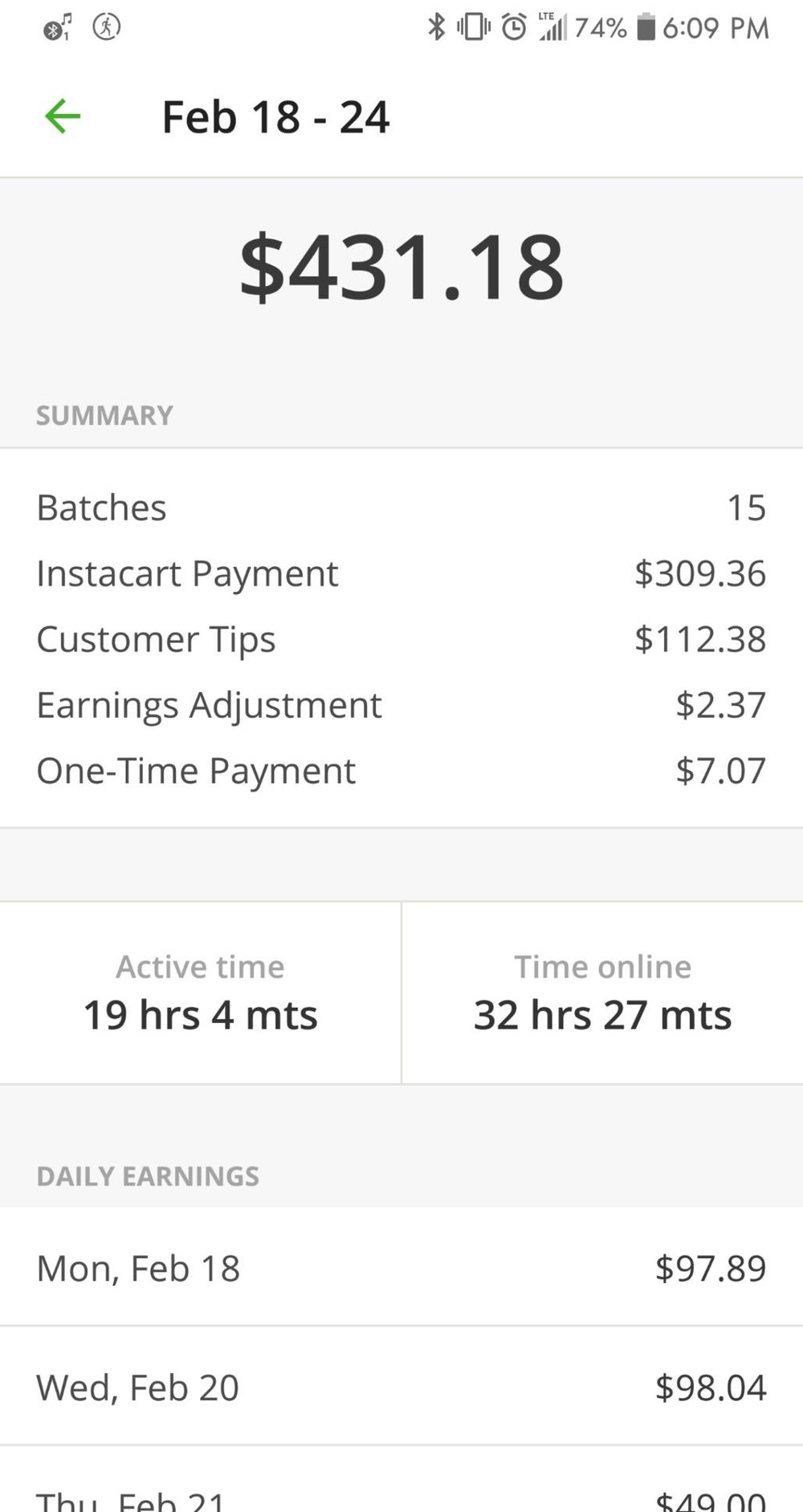

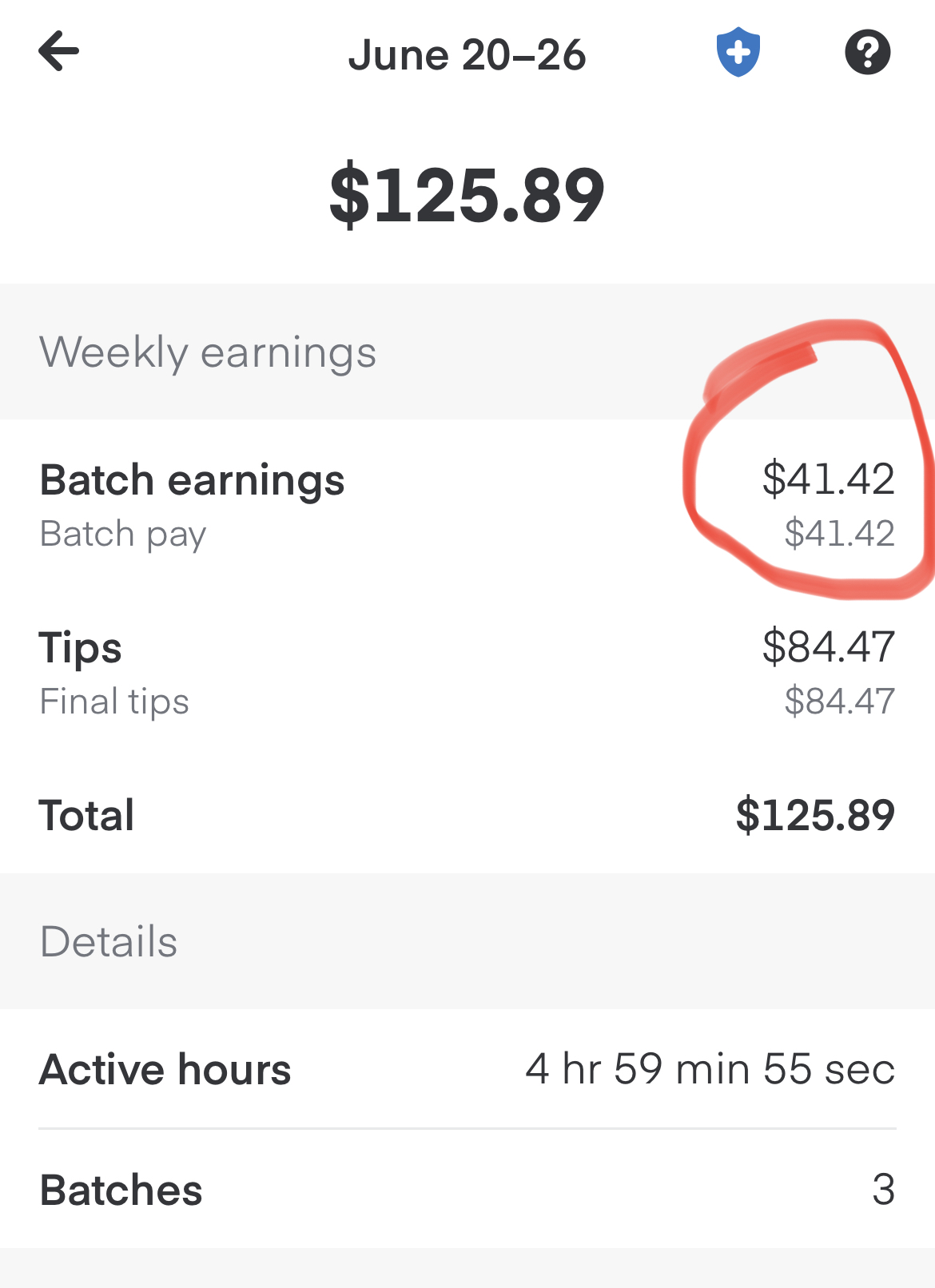

Instacart introduced the earnings section in 2021 to give easy access to its shoppers for their earnings which have to be submitted as proof while filing taxes. To actually file your Instacart taxes youll need the right tax form. Filing Instacart Taxes.

Because of this they are seen as self-employed and have to pay self-employment taxes. Please dont forget to SUBSCRIBE LIKE SHARE and COMMENT down below. Youll need to fill out this form and pay the corresponding Social Security and Medicare taxes which youre required to do even if your Instacart earnings arent enough to trigger them.

If you earned at least 600 delivery groceries. To file your quarterly taxes youll need to calculate your estimated taxes and pay what you owe by each of these deadlines. Unlike Federal and State taxes FICA taxes are calculated on gross all income instead of taxable income.

Determining Your Instacart Income. To pay your taxes youll generally need to make quarterly tax payments estimated taxes. Click Add next to the payment method you want to.

Like any other service or product taxes are included in the order total on your delivery receipt thats emailed to you upon the completion of your order. Pay Instacart Quarterly Taxes. How taxes work for Instacart shoppersInstacart taxes can get pretty complicated.

Do Instacart Shoppers Have to Pay Income Taxes. The IRS establishes the. Its possible that you didnt earn more than 600 in which case Instacart doesnt have to send you a form because the income isnt taxable.

Youll need to create an account and agree to e-delivery ie agree to receive your 1099 tax form electronically via Stripe Express to preview and download your 1099 tax form. April 18 2022 Pay estimated taxes. Learn the basic of filing your taxes as an independent contractor.

Knowing how much to pay is just the first step. The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis. The tax andor fees.

As already stated Instacart drivers are independent contractors.

Doordash Postmates Instacart Taxes Filing Gig Economy Taxes Youtube

What You Need To Know About Instacart Taxes Net Pay Advance

Doordash Postmates Instacart Taxes Filing Gig Economy Taxes Youtube

Instacart Driver Review 10k As A Part Time Instacart Shopper

How Much Does Instacart Pay Shoppers Delivery Groceries In 2022

How To Become An Instacart Shopper Pros Cons Pay Job Application

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart In California Every Other State R Instacartshoppers

Stop Ironing Shirts Instacart Shopper Stop Ironing Shirts

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Taxes The Complete Guide For Shoppers Ridester Com

All You Need To Know About Instacart 1099 Taxes

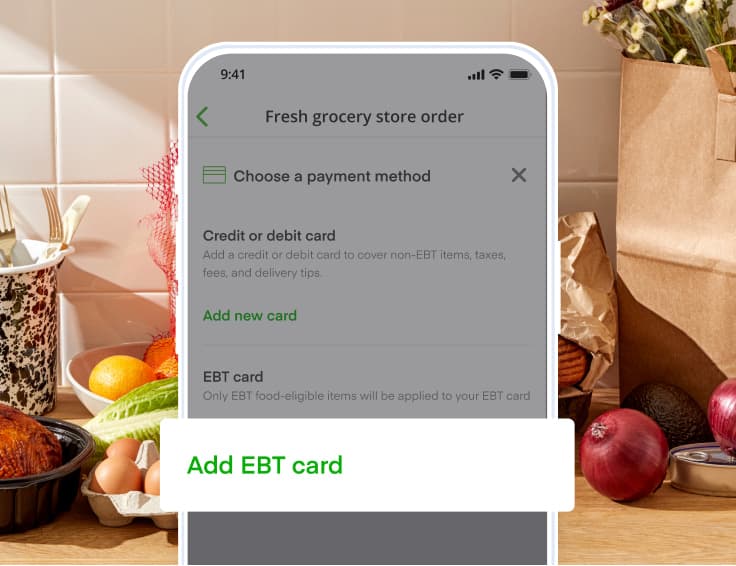

Use Ebt Snap For Grocery Delivery Or Pickup Instacart

What You Need To Know About Instacart 1099 Taxes

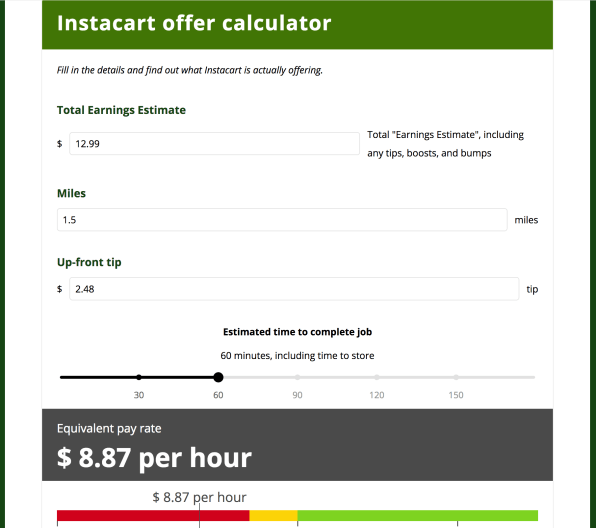

Delivering Inequality What Instacart Really Pays And How The Company Shifts Costs To Workers Payup

A Guide To Instacart Tipping How Much Should You Tip Your Shopper

How Self Employment Tax Works For Delivery Drivers In The Gig Economy

How To Handle Your Instacart 1099 Taxes Like A Pro

Instacart Drivers Say This Data Proves They Re Still Being Underpaid